We were reviewing customer data for a fibreglass pool kit company — routine work, mapping who was buying what — when a pattern jumped out of the spreadsheet.

Builders. Contractors. Property developers. Not the suburban families the brand was built around, but tradespeople placing repeat orders, referring three or more customers each, and generating close to half the company’s total revenue.

They’d found the product on their own. Nobody had gone looking for them.

That gap between “who you think your customer is” and “who’s actually driving your business” is where the biggest growth opportunities hide. Not in better ads. Not in bigger budgets. In the moment you stop talking to the average customer and start seeing the individuals.

The segment nobody was talking to

The pool kit company had built a strong business serving families. Suburban parents comparing quotes, looking for savings, wanting reassurance that DIY was achievable. Good product-market fit. Solid reviews. Healthy growth.

But when we broke the customer base into distinct segments — mapped from purchase data, review language, repeat behaviour, and referral patterns — the picture got more interesting.

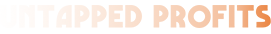

Segment one: Value-conscious families. About 40-45% of the market. The core audience the brand was built for.

Segment two: Premium DIY professionals. Tradies, builders, developers. Age 40-60, household income $120K-$250K. Around 25-30% of the market by volume — but contributing close to 50% of revenue. Higher margins. Multiple purchases. Three-plus referrals per customer.

Segment three: Frustrated premium seekers. Burned by other pool companies, willing to pay more for honesty.

Segment four: Investment property developers. Bulk buyers, fast decisions, repeat orders.

Four segments. Four completely different motivations, frustrations, and buying triggers. The brand had been built — successfully — around segment one. But segment two was quietly doing the heavy lifting, with no dedicated messaging, no tailored journey, and no specific outreach.

That’s not a failure. That’s an unlocked door.

Same product, completely different person

Here’s what made the opportunity so clear: the trades segment didn’t just want a different ad. They needed a different experience.

We built a detailed buyer profile for this group. Not demographics alone — a psychological map of what they feel, what they’ve tried, what drives their decisions, and what makes them bounce.

Their core motivation is professional pride blended with financial opportunity. As one profile put it: they’re frustrated by industry gatekeeping and insulted by markups on work they could do better themselves. They’re not browsing pool ideas for the backyard. They’re vetting a potential business supplier.

When this person hits a website, they skip the lifestyle imagery and go straight to the equipment list. They’re scanning for brand names they recognise — Astral, Zodiac, Hayward. If the kit includes unbranded gear, credibility drops immediately. They ignore beginner blog posts and hunt for spec sheets, engineering drawings, and dig sheets. They don’t want a price calculator with weekly payment options. They want a transparent pro-forma invoice and a delivery date.

The pool kit company’s value proposition was actually perfect for this person — wholesale shells, direct from manufacturer, massive savings on markup. Everything a tradie would want. But the experience was wrapped in language and design built for families discovering pools for the first time.

The product fit. The packaging didn’t.

Four journeys hiding inside one funnel

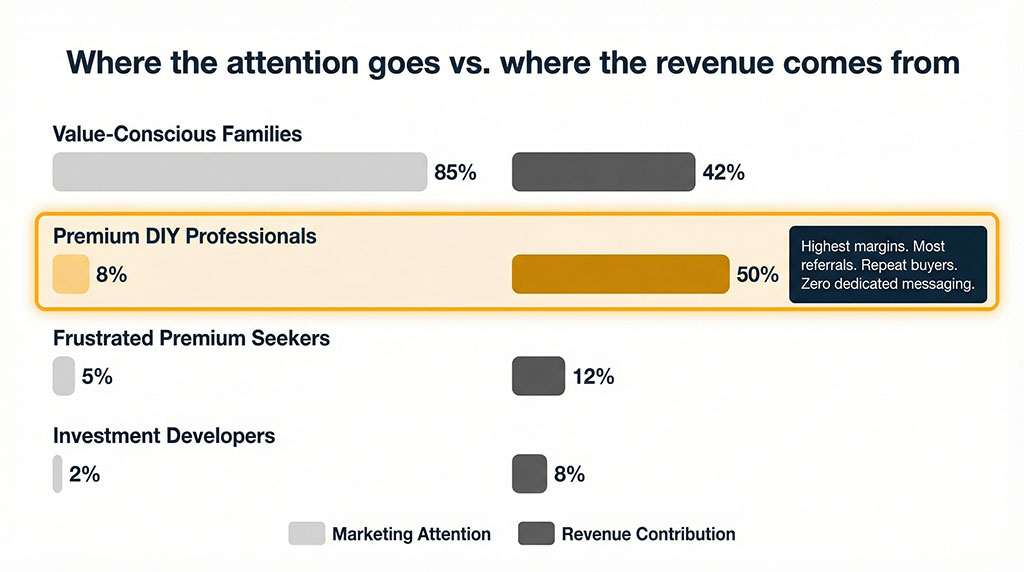

When we mapped the full customer journey for the trades segment, every touchpoint differed from the family journey. Not slightly — fundamentally.

Awareness: Families search “backyard pool ideas.” Tradies search “owner builder pool kit NSW” or “wholesale fibreglass pool shell supplier.” Different terms, different intent, different ad copy needed.

Education: Families read blog posts about pool colours and maintenance. Tradies want downloadable spec sheets, engineering drawings, and equipment brand lists. If the technical documentation looks professional, the company gains credibility. If it looks consumer-grade, they move on.

Consideration: Families compare prices online and fill out forms. Tradies pick up the phone and ask pointed questions about stock levels, lead times, and technical support. Their decision hinges on the competence of the person who answers.

Purchase: Families appreciate payment plans and financing options. Tradies want a clean, itemised pro-forma invoice. Fast. No fuss.

Post-purchase: The follow-up call to a family should ask for a review. The follow-up call to a tradie should say: “How did the install go? We have a trade program for builders who want to do more of these for clients.”

One product. Two completely different people. And when you run them both through the same funnel, you get a message that half-serves both and fully serves neither.

"But we already segment our audiences"

This is the objection I hear most. And it’s reasonable — on the surface.

You’ve built different audiences in Meta. You have remarketing lists in Google. Maybe separate ad creative for different groups. That looks like segmentation in the platform dashboard.

But follow the click.

Your “trades” audience clicks your ad and lands on… the same page as everyone else. Same messaging. Same imagery. Same journey. Same offer structure. A builder lands on a page with family lifestyle photos, a DIY price calculator offering weekly repayments, and articles titled “How to Prepare Your Backyard for a Pool.” These are people who excavate sites for a living.

Platform-level targeting without journey-level differentiation is just averaging within smaller boxes. Real segmentation means the language changes, the proof points change, the offer changes, and the entire path from first click to follow-up call is built for a specific person with specific needs.

The pool kit company wasn’t doing anything wrong by focusing on families. They’d built a successful business around that segment. The opportunity was in recognising that a second, equally valuable audience had arrived on its own — and was being served a journey designed for someone else entirely.

Why this stays invisible

Jon Epstein — one of the sharpest data minds in direct marketing — has been saying this for decades: never talk about the average customer. There is no such beast. We are talking about individuals.

He found that 10% of one client’s customer file produced over 90% of results. Not 80/20. Not a gentle curve. Ten percent doing almost everything.

That kind of concentration hides easily when your marketing is spread across disconnected channels. Your Google Ads person sees click-through rates. Your Meta person sees audience performance. Your email team sees open rates. Each one optimises their channel for “the average visitor.”

Nobody can see that a builder from regional NSW who clicked a search ad, spent four minutes looking for spec sheets that don’t exist, and bounced — is the same type of person as the contractor who called last week asking about trade pricing that isn’t offered.

The pattern only becomes visible when one view holds all the data. Search terms, site behaviour, phone enquiries, purchase history, repeat orders — together, not siloed. That’s when the segment that’s been quietly carrying your business reveals itself. And that’s when you can actually build something for them.

What happens next

A dedicated trades acquisition campaign is now in development for the pool kit company. Different search targeting. Different landing experience. Different language and proof points. A post-enquiry journey built for someone who doesn’t need convincing that a pool is a good idea — they need a supplier who treats them like a professional.

The product didn’t change. The pricing didn’t change. The family-focused business that got them here? Still running, still strong. The only thing that changed was the willingness to look past the average and ask: who else is here, and what do they actually need?

Somewhere inside your customer data, there’s a segment doing the heavy lifting while getting none of the attention. Not because you failed them — but because you haven’t looked for them yet.

That builder is still scrolling. The spec sheets are almost ready.

See What’s Hiding in Your Customer Data

You’re probably marketing to “your customer” — one message, one funnel, one journey. But somewhere in your data, there’s a segment driving disproportionate revenue with zero dedicated attention. We find it.

Most clients discover two or three high-value segments being funnelled through a journey built for someone else entirely. Takes 30 minutes.

You don’t need more traffic. You need to stop talking to the average customer.