Last year a client slid a spreadsheet across the table. Seven columns. Four agencies. Google Ads, Meta, SEO, content, YouTube pre-roll, a LinkedIn campaign someone started in March and forgot about by April. Monthly spend: $11,000. Revenue attributable to marketing: he had no idea.

He wasn’t stupid. He’d built a trades business from nothing to 500k in 2 years. But when I asked him one question—”What does a new customer cost you?”—he went quiet.

That silence is more common than you’d think.

After sitting across from dozens of business owners with the same blank look, I’ve boiled the problem down to four diagnostic questions. They’re simple. Deceptively so. Every business owner I’ve tested them on thought they knew the answers—until they actually tried to answer them with specifics.

These aren’t theoretical. They’re designed to locate the exact joint in your marketing where the fracture is hiding. Answer them honestly, and you’ll know—within minutes—where your next dollar of profit is trapped.

Question 1: Do you actually know your customer—or just their postcode?

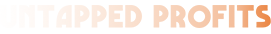

Most business owners answer this one fast. “Yeah, mate—tradies, 25 to 45, Western Sydney.”

That’s a demographic. It’s not a customer.

Knowing your customer means knowing what keeps them scrolling at 11 PM. It means understanding the specific objection that stops them mid-checkout. It means knowing which word in your headline makes them lean in—and which one makes them bounce.

Harry Browne nailed this decades ago in The Secret of Selling Anything: your first job isn’t to pitch—it’s to uncover what already motivates your prospect. Most sales die because someone presented a solution before they understood the problem.

That principle hasn’t changed. But the tools have.

You’ve probably heard the stat about people seeing thousands of marketing messages a day. The exact number doesn’t matter. What matters is that your prospect is drowning—and generic messaging is invisible to a drowning person. They only see the hand that reaches for them specifically.

Modern websites can personalise by the campaign that brought someone in, by the content they’ve consumed, by the stage of their buying journey. One client—a mortgage broker—started showing different landing pages based on whether the visitor came from a ‘first home buyer’ ad or a ‘refinancing’ ad. Conversion rate went from 2.1% to 5.7% in six weeks.

Here’s the test: if you swapped your homepage headline with your competitor’s, would anyone notice? If the answer is yes, you don’t know your customer well enough yet.

Your diagnostic question: Can you describe your ideal customer’s biggest objection to buying from you—right now, from memory, without checking notes?

If you can’t, that’s your first fracture.

Question 2: Can you buy a new customer and know what they're worth?

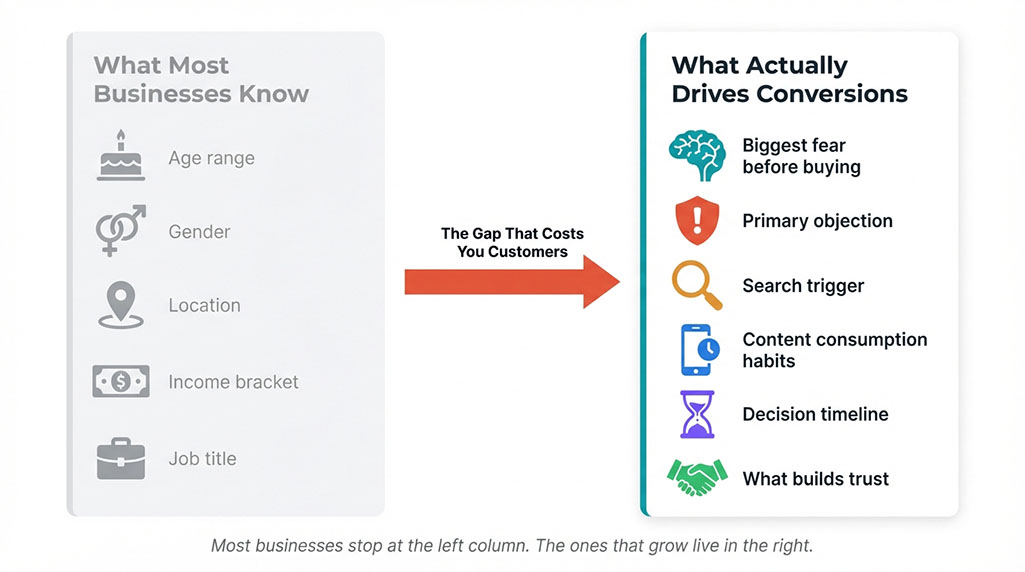

This is where most marketing conversations go wrong. Business owners fixate on the cost of getting a customer through the door. They see $200 in ad spend for one sale and wince.

But that’s only half the equation—and it’s the less important half.

The real question is: what is that customer worth over 12 months? Over three years? Over the lifetime of the relationship?

I worked with a lighting who was spending $60 per lead on Google Ads. They thought it was too expensive. When we tracked customer lifetime value, each new customer was worth $850 over 12 months. Suddenly that $60 acquisition cost looked like a bargain.

Businesses that don’t track this end up making decisions based on feelings. “Ads are too expensive.” “SEO takes too long.” “We tried Facebook, it didn’t work.” These aren’t strategic conclusions. They’re emotional reactions to incomplete data.

Here’s the part most business owners miss: the goal of the first sale isn’t profit. It’s acquisition. The most successful businesses I’ve worked with are perfectly happy to break even on that first transaction—because they’ve done the maths on the back end. They know that a customer acquired at zero profit on day one becomes $2,000 in margin over 18 months. While their competitors agonise over making every ad click profitable immediately, they’re playing a longer game—and winning it.

You can’t make that bet if you don’t know the numbers. And you can’t know the numbers if you’re not tracking what happens after the first transaction.

Your diagnostic question: What is the average lifetime value of your customer—and how does that compare to what you spend to acquire them?

If you don’t have a number—even a rough one—that’s fracture number two.

"You're nodding. That's the problem."

You’ve read two questions. You’re probably nodding. “Yes, I should know my customer better. Yes, I should track lifetime value.” It all sounds sensible on paper.

But here’s what I’ve found after running this diagnostic with [BRUCE: number] businesses: almost everyone thinks they can answer these questions. Almost no one actually can—with numbers.

“I know my customer” usually means “I have a vague sense of who buys from us.” “I know my numbers” usually means “I check the bank balance and see if it went up.”

That’s not a diagnostic. That’s a horoscope.

The next two questions are where it gets uncomfortable, because they’re harder to fake. You either have the systems or you don’t. You either have the data or you’re guessing.

And if you’re guessing—especially if you’re spending real money on marketing—the cost of those guesses compounds every single month.

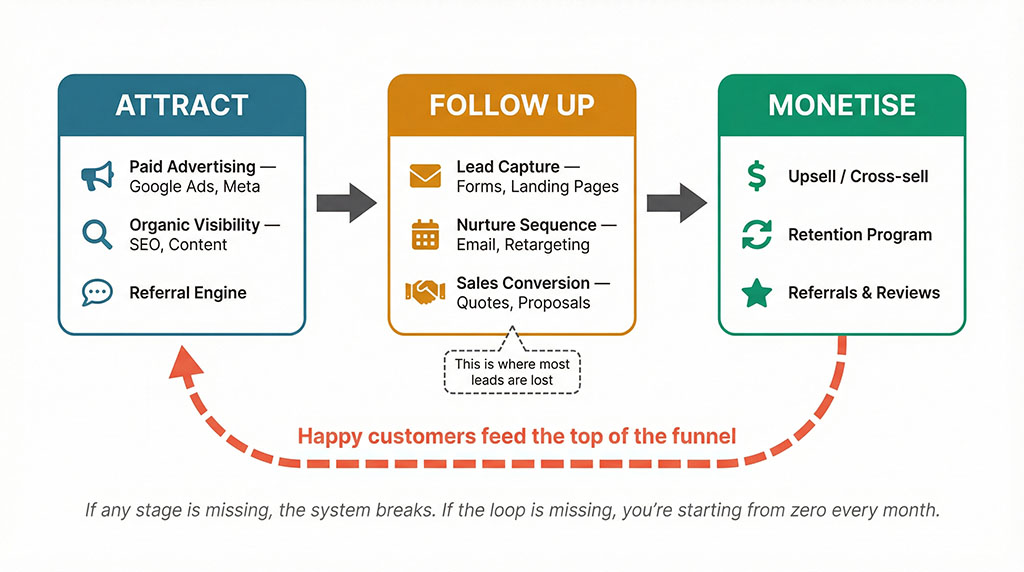

Question 3: Can you tell me, right now, what each marketing campaign returned?

This is the question that produces the longest silence.

Not “do you run campaigns?” Most businesses do. Not “do you have Google Analytics?” Most businesses have it installed somewhere, collecting dust like a gym membership in February.

The question is: if I sat across from you right now and asked what your last three campaigns produced in terms of enquiries, customers, and revenue, could you tell me?

I’ve asked this question to business owners spending $5,000, $15,000, even $30,000 a month on marketing. The answer, more often than not, is a shrug and ‘We’ve been pretty busy lately.’ That’s not measurement. That’s hope.

Here’s why this matters more than any other question on this list: without measurement, you can’t improve. You can only change. And change without data is just restless motion.

The businesses that grow predictably—the ones that aren’t on the revenue roller coaster—share one trait. They know their numbers at the channel level. They know that Google Ads brings in leads at $[X], that SEO leads convert at [Y]%, that their email list generates $[Z] per subscriber per year. [BRUCE: Adjust these examples to match your typical client profile.]

When you have that data, marketing stops being a gamble and starts being a lever. You put a dollar in here, you get three dollars out there. You can scale what works and kill what doesn’t—without emotion, without argument, without gut feeling.

Your diagnostic question: Can you state the cost per lead and cost per acquisition for each active marketing channel—from memory?

If you can’t, you’ve found fracture number three. And it’s probably the most expensive one.

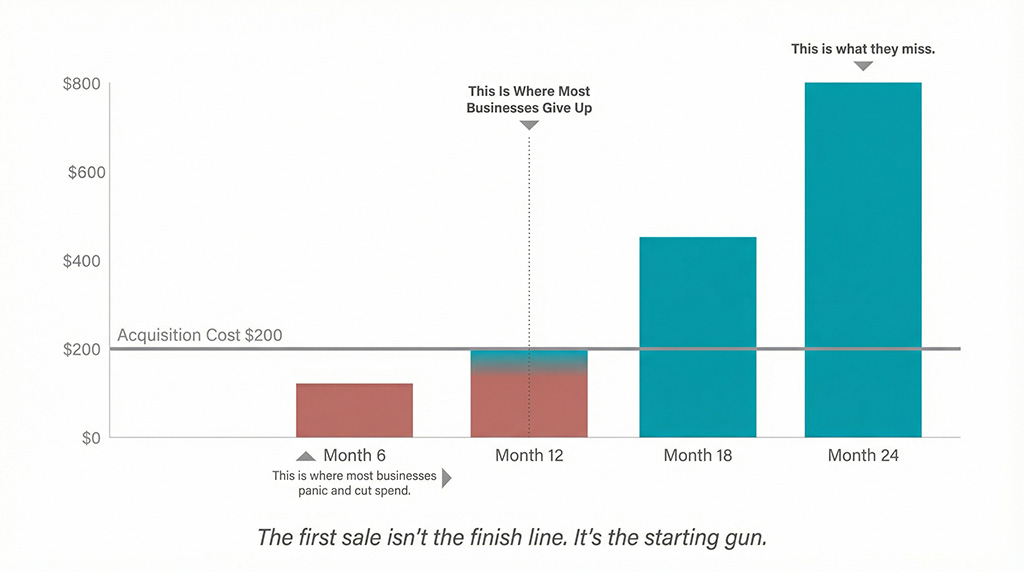

Question 4: Does your marketing run as a system—or depend on someone remembering?

This question comes last for a reason. You should never systemise marketing that isn’t working. A system applied to a broken process just produces broken results faster.

But once you’ve answered the first three questions—once you know your customer, understand your unit economics, and can measure your results—the final step is turning it from a manual effort into a machine.

One client was doing everything manually. Every new lead got a personal email—when someone remembered. Follow-ups happened on Post-It notes. When we mapped the process and automated it, their lead-to-sale conversion rate went from 8% to 22%—not because the marketing got better, but because leads stopped falling through the cracks.

Most businesses have systems for how they deliver their service. They have systems for invoicing, for scheduling, for operations. But when it comes to marketing—the thing that feeds every other system—they’re winging it.

A marketing system means three things are defined and automated:

How you attract leads. Not “we post on social media sometimes.” A defined channel, with a defined budget, producing a defined number of leads per month.

How you follow up. The average prospect needs 8 touchpoints before they buy. If your follow-up is “we send a quote and hope they call back,” you’re leaving most of your revenue on the table.

How you monetise every customer. Back to Question 2—once someone has bought from you, what happens next? Is there an upsell? A referral program? A re-engagement sequence? Or do they disappear into the void until they happen to need you again?

A system, by definition, delivers predictable results. When you invest $1,000, you know—not hope, not guess—what comes back. That predictability is the difference between a business that scales and a business that stays stuck on the hamster wheel.

Your diagnostic question: If you stepped away from your business for a month, would your marketing keep generating leads—or would it stop the day you stopped pushing?

If it stops, you don’t have a system. You have a habit. And habits break.

Where does this leave you?

Four questions. Four potential fractures. And if you’re like most of the business owners I work with, at least two of them hit a nerve.

That’s not a failure. That’s a diagnosis. And a diagnosis is the first step to fixing it.

Here’s what I’d suggest: don’t try to fix all four at once. Pick the one that made you the most uncomfortable—the question where the silence lasted longest—and start there.

If it’s Question 1, spend a week talking to your last 10 customers. Not surveying them. Talking. Ask what almost stopped them from buying. The answers will reshape your messaging overnight.

If it’s Question 2, pull your sales data from the last 12 months. Calculate what a customer is worth over their full relationship with you. That one number will change how you think about acquisition spend.

If it’s Question 3, set up basic tracking. [BRUCE: You could recommend a specific tool or approach here, e.g., “Even a simple spreadsheet that tracks leads, source, and outcome per campaign is better than nothing.”] You’ll start seeing patterns within 30 days.

If it’s Question 4, map your customer journey on a whiteboard. Every touchpoint. Every handoff. Every place where a lead could fall through a crack. Then automate the most painful gap first.

Remember the client with the spreadsheet? Seven columns, four agencies, $11,000 a month, no idea what was working?

We ran these four questions. Turned out he knew his customer reasonably well (Question 1 was solid), but he couldn’t answer Questions 2, 3, or 4 with anything resembling data. Within [BRUCE: timeframe], we’d cut his spend to [BRUCE: new spend], doubled down on the two channels that were actually producing, built a follow-up sequence that recovered [BRUCE: X% or $X] in previously lost leads, and systemised the whole thing so it ran without him checking in daily.

His marketing spend went down. His revenue went up. Not because we found some magic tactic—but because we fixed the fractures.

That spreadsheet still sits on my desk. It’s a good reminder that the answer is almost never “spend more.” It’s almost always “know more.”

This is exactly what we do in the Agency Waste Audit.

It’s a free, 30-minute session where we run a deeper version of this diagnostic on your specific business—with your actual numbers, your actual channels, and your actual gaps. Most clients find at least one five-figure leak they didn’t know existed.

Book Your Free Agency Waste Audit →