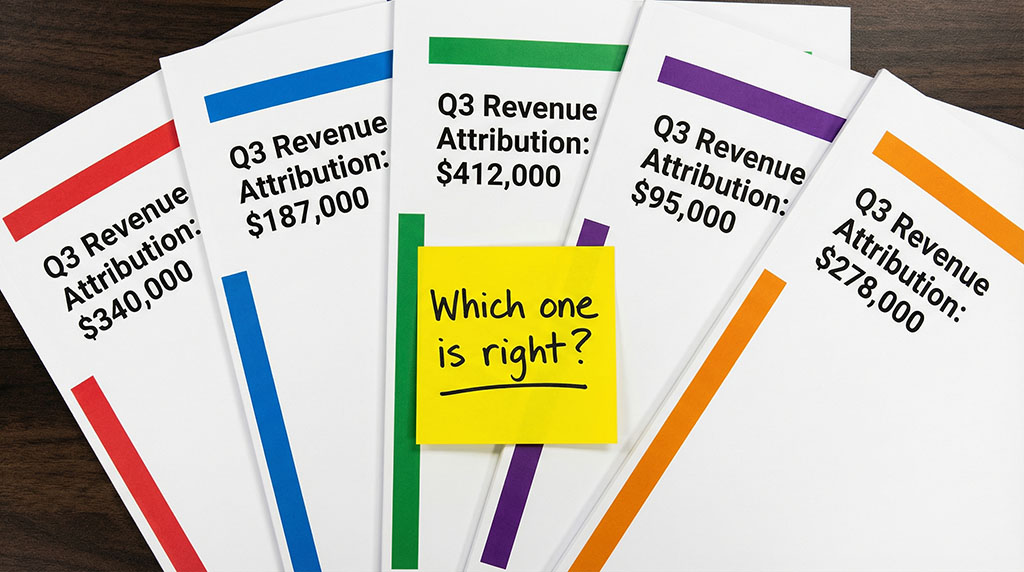

Last quarter, a mid-sized ecommerce brand discovered that their Facebook agency and their Google agency were targeting the same 40,000 people with the same offer through two different channels. Both agencies reported “strong reach.” Neither knew the other existed. The brand was paying twice to annoy the same audience – and calling it strategy.

This isn’t a one-off. It’s the structural consequence of splitting your marketing across specialists who can’t see each other’s work. And the data from McKinsey, BCG, Gartner, and Harvard now points in one direction: the multi-agency model isn’t underperforming. It’s collapsing.

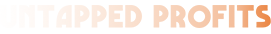

The numbers behind the fracture

Marketing budgets have flatlined at 7.7% of revenue, according to Gartner’s 2025 CMO Spend Survey of 402 marketing leaders. Down from 10–11% pre-pandemic. That budget isn’t growing back. Yet within that shrinking envelope, companies continue funding an average of 3.33 agency relationships per marketer (ANA), each running separate tools, separate dashboards, separate definitions of success.

The waste compounds at every layer. Gartner found that companies use only 33% of their marketing technology capabilities—down from 58% in 2020. Not because the tools are bad, but because fragmented teams buy overlapping solutions that nobody fully adopts. Meanwhile, Asana’s research across 10,000 knowledge workers shows that 53% of working time goes to coordination and busywork rather than actual strategic work. When your agencies don’t share data, that percentage climbs higher.

And the price of fragmentation isn’t just time. Gartner pegs the cost of poor data quality at $12.9 million per year per organization. The ANA’s programmatic transparency study—based on log-level impression data from 21 major advertisers—found $26.8 billion in unrealized media value globally, driven partly by supply chain fragmentation. The number of supply partners per advertiser grew from 14 to 19 in a single year. More middlemen. More opacity. Less return.

Here’s the pattern nobody talks about: media-only agencies last an average of 3.7 years before being replaced. Full-service agencies last 7.3 years. The fragmented model doesn’t just cost more—it churns faster. And every pitch cycle costs an average of $408,500 (ANA/4As). You’re paying a premium to be perpetually starting over.

What unified intelligence actually looks like

The counterargument is obvious: specialization produces expertise. A dedicated SEO agency knows search better than a generalist ever could.

That was true when the bottleneck was knowledge. It’s no longer true when the bottleneck is integration.

BCG’s 2025 measurement study found that companies unifying their marketing analytics—combining marketing mix modeling, incrementality testing, and multi-touch attribution into a single framework – deliver up to 70% higher revenue growth than their peers. Not 7%. Seventy. The gap between seeing your marketing as connected channels versus isolated silos is that large.

McKinsey documents a 15–20% ROI lift from integrated full-funnel management compared to siloed channel approaches. Their analysis specifically flags the problem we opened with: media mix models will recommend increasing spend on branded search terms even when the brand already captures nearly 100% of organic results. A unified view catches this. Separate agencies never will – because the agency running paid search has every financial incentive not to mention it.

BCG and Google’s multi-year experiments with 200 brands found that companies achieving full data integration reported a doubling of ROAS and 30–50% improvement in conversion rates. Salesforce’s survey of 4,850 marketers across 29 countries found that teams with a unified customer journey strategy were 8.8 times more likely to be classified as high performers.

This isn’t incremental. Unified intelligence is a different category of capability.

One marketer with AI versus five agencies without it

In September 2023, Harvard Business School, MIT Sloan, Wharton, and BCG published something unusual: a pre-registered randomized controlled experiment—the gold standard in research design—testing what happens when consultants use AI. They gave GPT-4 to 758 BCG consultants across 18 realistic tasks including creative, analytical, and marketing work.

The results: AI-assisted consultants completed 12.2% more tasks, finished 25.1% faster, and produced work rated over 40% higher quality. Ninety percent of participants improved. Below-average performers saw a 43% boost—the biggest gains went to the people who needed them most.

Apply that to the marketing context. McKinsey projects that generative AI could increase marketing productivity by 5–15% of total marketing spend, worth roughly $463 billion annually across the industry. Their European State of Marketing survey found that the 6% of executives with mature AI implementations already report 22% efficiency gains—and expect those gains to reach 28% within two years.

This is where the math breaks the old model. If AI compresses the work that took 100 agency hours into 10 hours of AI time plus 5 of human oversight, the billable-hour structure evaporates. The value shifts from execution capacity to strategic integration—the ability to see all channels, all data, all customer touchpoints at once, and make decisions that account for the whole picture.

Gartner’s 2025 survey found that 40% of CMOs already use AI to automate creative generation and ad operations. More telling: 22% said AI directly makes them less dependent on agencies for creative and strategy. The CMO Survey from Duke and Deloitte tracked AI adoption in marketing growing 116% year-over-year, now covering 15.1% of all marketing activities—projected to reach 44.2% within three years.

The companies pulling ahead aren’t just using AI as a faster tool. BCG and Google’s survey of 2,000+ marketers found that AI leaders achieve 60% greater revenue growth than their peers. And McKinsey’s State of AI report shows that high-performing AI organizations are three times more likely to have fundamentally redesigned their workflows—not just bolted AI onto existing processes.

"This is consultant-speak for selling a different kind of dependency"

Fair objection. Let’s sit with it.

The research I’ve cited comes overwhelmingly from consultancies that profit when companies restructure. McKinsey sells transformation projects. BCG sells measurement frameworks. Gartner sells advisory subscriptions. Every one of them has a commercial interest in you believing the old model is broken.

And the counterpoints are real. Over 80% of companies remain in early AI stages, according to BCG. Two-thirds are stalled by lack of knowledge or too many options. The Harvard/BCG experiment also found a “jagged frontier”—AI dramatically improved performance on some tasks while actually degrading quality on others that fell outside its competence boundary. AI is not a magic wand, and one person with ChatGPT is not a replacement for genuine creative expertise developed over decades.

Agencies provide real value. External perspective prevents internal echo chambers. Deep specialization in complex areas like programmatic buying or brand strategy draws on institutional knowledge that doesn’t transfer easily. The WFA found that satisfaction with in-house agencies sits at 86%, but only 33% report complete satisfaction—meaning the majority still see gaps.

So this isn’t an argument that all agencies are useless. It’s an argument that the model—five separate agencies, five separate data sets, five separate incentive structures pulling in different directions—is structurally incapable of delivering what the market now demands: unified intelligence. McKinsey found that only 27% of marketing leaders have operating models they’d describe as mature and fit for purpose. Only 12% cite effective governance. The model isn’t just expensive. For most companies, it was never properly built in the first place.

The question isn’t whether you need external expertise. It’s whether that expertise should come from five disconnected specialists who can’t see each other’s data, or from a consolidated structure—whether that’s one exceptional person with AI, a lean integrated team, or a single strategic partner—that operates from a single source of truth.

The shift is already happening

This argument would be theoretical if companies weren’t already moving. They are – at scale.

ANA data shows that 82% of member companies now operate in-house agencies, up from 42% in 2008. That’s not a trend. That’s a structural reversal over 15 years. Sixty-five percent moved work previously handled by external agencies in-house within the past three years.

The World Federation of Advertisers found that 66% of major multinational brands now have in-house capabilities—up 16 percentage points from 2020 alone—and 56% plan to bring more digital production in-house within three years. Only 11% believe their current agency model aligns with future requirements. Thirty-seven percent are actively seeking fewer, more integrated partners.

The financial data tells the same story from the other side. The Big Six agency holding companies’ share of total US ad spend dropped from 44.6% in 2019 to 29.6% in early 2024. Brand-direct spending nearly tripled over the same period. Forrester predicts a 15% reduction in agency jobs in 2026 alone. Collective headcount across the holding companies fell by over 7,000 people in 2024—the first decline since the pandemic.

The agencies themselves know. WPP cut 5.4% of its workforce. The rest are restructuring around AI. The ones that survive will look nothing like the ones you’re paying today.

What the transition actually requires

McKinsey’s analysis is specific: modernizing marketing operations unlocks 5–15% of additional growth and trims 10–30% of costs. But the key word is “modernizing”—not just switching vendors. The BCG maturity data reveals that the average level of marketing maturity actually fell 8% from 2021 to 2024 as the bar keeps rising. Doing this well is genuinely hard.

The practical path looks something like this.

Weeks 1–4: Map the intelligence gaps. Audit every tool, every dashboard, every data source across all your current agencies. Document where data doesn’t flow between systems. Identify the decisions you currently make based on incomplete information—this is usually a longer list than anyone expects.

Weeks 5–8: Consolidate the data layer first. Before changing any agency relationships, unify your analytics. This is the foundational step. As McKinsey notes, AI can only optimize what it can see. If your data remains fragmented, AI will optimize for local maximums—clicks, opens, impressions—rather than global ones like profit and lifetime value.

Weeks 9–12: Redesign the workflow, not just the org chart. McKinsey’s State of AI research shows high performers are three times more likely to have fundamentally redesigned workflows rather than simply layering AI onto existing processes. This means rethinking how decisions get made, not just who makes them.

Month 4 onward: Shift external relationships from execution to expertise. Agencies aren’t the enemy. Fragmentation is. The future model uses external specialists for genuine strategic input and capability spikes—the work that requires deep institutional knowledge you can’t build overnight—while keeping intelligence, data, and decision-making unified internally.

What happens when one person sees both screens

Remember the two agencies targeting the same 40,000 people? In a consolidated model, the marketer sees the overlap on day one. They merge the audiences, kill the duplicate spend, and redirect budget into untouched segments that neither agency knew existed. Cross-channel frequency capping alone lifts campaign effectiveness by up to 32% (IAS). Not because the creative improved. Because someone could finally see both channels on the same screen.

That’s the difference between marketing as a collection of disconnected tactics and marketing as an integrated intelligence system. Every data point in this piece—from BCG’s 70% revenue growth gap to McKinsey’s 15–20% ROI lift to the 8.8x high-performer multiplier—traces back to one structural advantage: the ability to see the whole picture at once.

Thirty-nine percent of CMOs are already cutting agency budgets. Eighty-two percent have built in-house capabilities. The model isn’t ending because AI made it obsolete. It’s ending because AI made the cost of fragmentation visible for the first time.

The question isn’t whether this shift happens. It’s whether you spot your own 40,000-person overlap before your competitor does.

Book your 30-minute Agency Waste Audit →

Your current setup. Where your agencies overlap, conflict, and burn budget. Because in six months, you’ll either have unified intelligence – or still be paying two agencies to chase the same 40,000 people.