The survey came back clean. “Price” ranked first. “Features” second. “Brand reputation” third. Neat. Tidy. Useless.

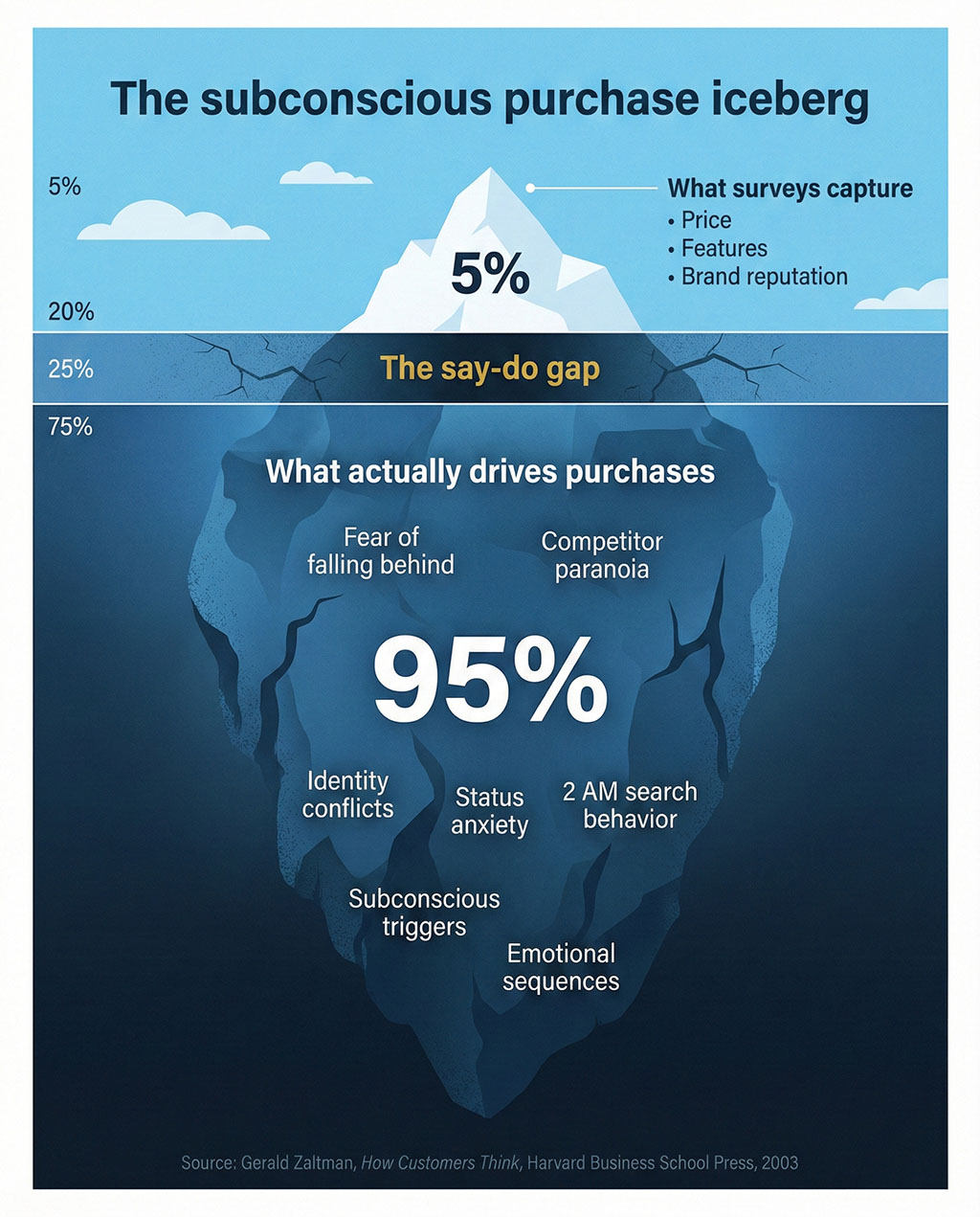

That same week, your highest-value customer segment was Googling something entirely different at 2 AM: “why is my competitor suddenly everywhere.” Not your pricing page. Not your feature comparison. A fear they’d never admit to your face, your focus group, or your annual satisfaction survey.

This is the gap that’s bleeding you dry. Not the gap between your product and theirs. The gap between what customers say they want and what actually makes them reach for a credit card.

And the data on that gap is brutal.

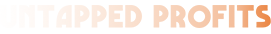

95% of buying decisions happen where surveys can't reach

Harvard Business School professor Gerald Zaltman spent years studying how people actually make purchasing decisions. His finding: 95% of purchase decision-making takes place in the subconscious mind — territory that traditional surveys, focus groups, and customer interviews simply cannot access (How Customers Think, Harvard Business School Press, 2003).

That’s not a rounding error. That’s the whole game.

Think about your own buying. You tell yourself you chose the restaurant because of the reviews. But it was the way the menu looked on Instagram three weeks ago that planted the seed. You “decided” before you ever checked a rating. Your customers do the same thing — and then rationalize it afterward in ways that make them sound logical on your NPS survey.

Harvard Business Review research puts a number on it: 65% of consumers say they want to buy sustainable brands, yet only 26% actually do (White, Hardisty & Habib, HBR, 2019). A gap of nearly 60% between stated intention and real behavior. Your surveys are capturing the performance. The purchase happens backstage.

AI research doesn't ask. It watches.

This is where it gets interesting. Stanford and Columbia researchers published a study in PNAS — one of the most prestigious scientific journals on the planet — testing what happens when you skip the survey entirely and go straight to behavioral data. They matched advertising to personality traits inferred from digital footprints across 3.5 million users.

The result: psychographically targeted ads produced up to 50% more purchases than generic ones (Matz, Kosinski et al., PNAS, 2017).

Not 50% more clicks. Not engagement. Purchases.

Because AI research doesn’t care what your customer says on a form. It maps what they search at 2 AM, what they argue about in Reddit threads, what language they use when they think nobody’s tracking it. The patterns that emerge look nothing like your buyer persona deck.

A 28-year-old SaaS founder in Silicon Valley and a 67-year-old manufacturer in Ohio. Your agencies would never put them in the same segment. Demographics say they have nothing in common. But they’re Googling the exact same phrase — “why is my competitor suddenly everywhere” — and losing sleep over the same fear: watching rivals move faster while they’re stuck in coordination meetings.

Both buy based on one trigger: speed to market. Not price. Not features. Speed.

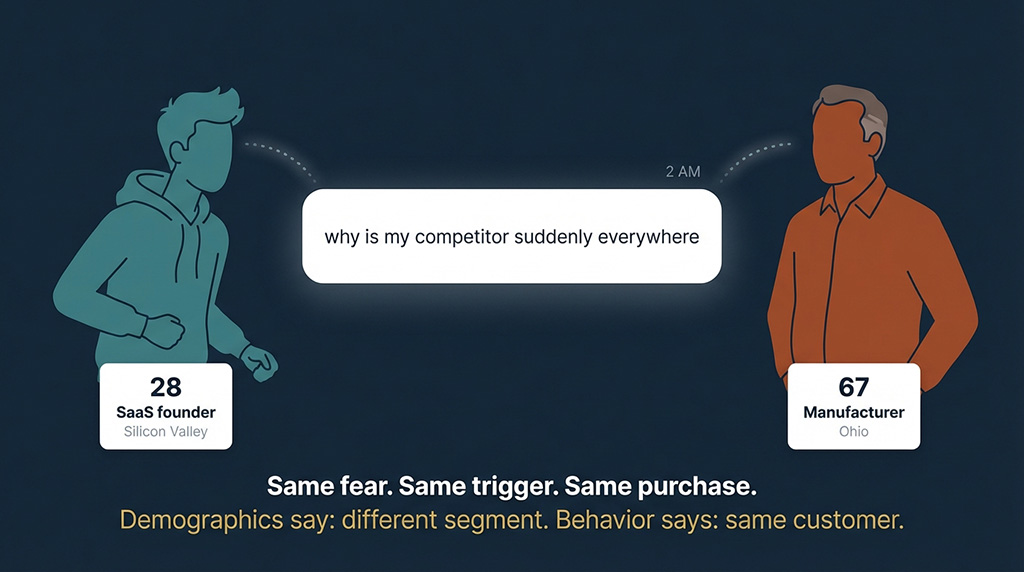

Now imagine that insight hitting five different inboxes.

Here’s where the whole thing falls apart.

AI research surfaces something real — an unconscious fear, a trigger phrase, an identity conflict your customer would never articulate in a boardroom. Gold. The kind of insight that changes positioning overnight.

And then it lands on five agency desks.

Your Facebook agency reads “speed to market” and writes ad copy about “staying ahead.” Your Google Ads team targets keywords around “competitive analysis tools.” Your SEO agency produces a listicle: “10 Ways to Outpace Your Competition.” Your email team writes a nurture sequence about “not getting left behind.” Your content agency publishes an industry trends report that mentions speed once, in paragraph nine.

Same insight. Five interpretations. Zero coherence. Your customer gets hit with five versions of a message that should have been one story told across five chapters.

The World Federation of Advertisers surveyed 70+ multinationals representing over $50 billion in ad spend. Only 11% believe their current agency model is fit for the future. Not “could use improvement.” Eighty-nine percent said the structure itself is broken (WFA/MediaSense, 2023).

"But my agencies communicate."

No. They report. To you. Separately. On different timelines, in different formats, measuring different metrics.

Communication would mean your Google Ads data reshaping your Facebook creative within days. It would mean your email engagement metrics directly informing which landing pages get built next week. It would mean one team seeing that “agency waste” converts and “marketing integration” doesn’t — and every channel adjusting overnight.

That doesn’t happen when five vendors optimize five dashboards. Each one wins their game. You lose yours.

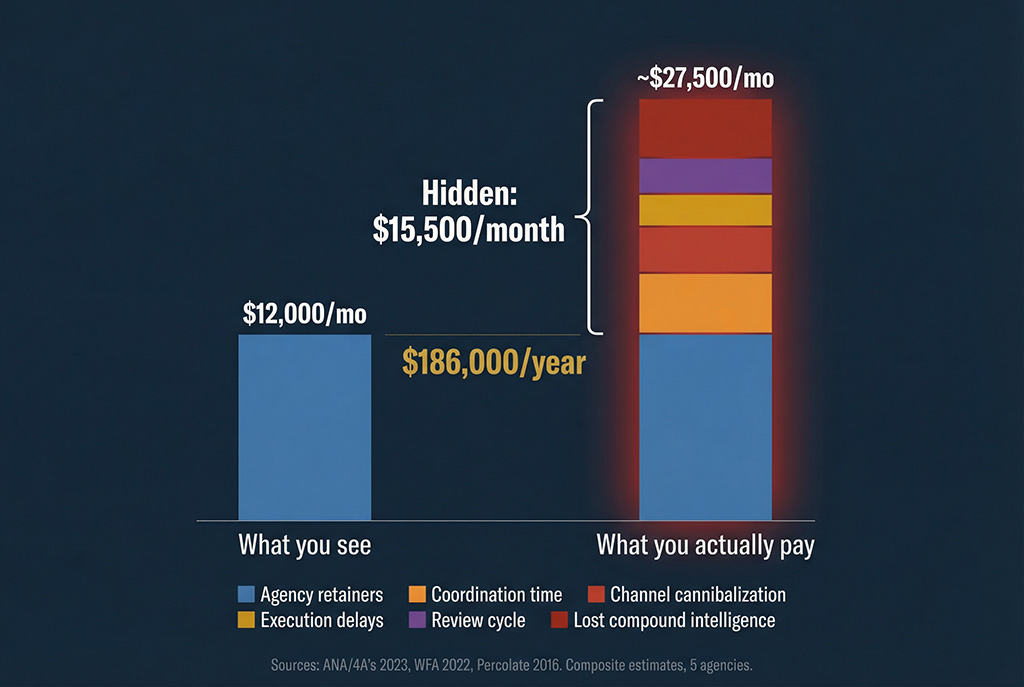

And the cost of maintaining this dysfunction goes deeper than retainers. The ANA found that a single agency review costs marketers $408,500 on average. Factor in the incumbent defending and competitors pitching, and one review burns over $1 million across all parties (ANA/4A’s/Advertiser Perceptions, 2023). Average contract length? Eighteen months per WARC data. So every year and a half you spend a million dollars replacing a team that just started understanding your customer — and the next team starts from zero.

P&G did the math. They cut their roster from 6,000 agencies to 2,500. Saved $750 million (P&G earnings calls, 2014–2018). Unilever’s CFO projected $470 million in savings from a similar consolidation.

That’s not a management tweak. That’s proof the model itself is the tax.

The same survey. A different Monday.

Imagine running that customer survey again. “Price” still ranks first. “Features” second. You nod. Tidy.

But this time, underneath the survey, you have the 2 AM data. The Reddit threads. The search behavior. The language patterns your customers use when they think nobody’s watching. And instead of five agencies pulling that intelligence in five directions, one integrated system turns it into one story — told differently on each channel, but building toward the same crescendo.

Facebook introduces the fear. Google captures the search it creates. Email addresses it directly. Every touchpoint compounds the last.

The gap between what your customers say and what they do? It’s still there. It’s always been there. The difference is whether anyone in your marketing operation is paying attention to the right side of it — and whether the people who are can actually act on it without five competing translations.

Gartner’s 2025 CMO Spend Survey says 39% of CMOs are cutting agency budgets. Eighty-two percent of ANA members now run in-house agencies, up from 42% in 2008. The market figured out the survey was lying. The question is whether your marketing model is still listening to it.

That clean survey is still sitting in your inbox. Neat. Tidy.

Now what are you going to do about the 95% it missed?

Book Your Agency Waste Audit →

Thirty minutes. We’ll show you exactly where your agencies overlap, conflict, and dilute the customer insights that should be driving your growth — with dollar figures attached.

Get Your Audit →